GreenYield

GreenYield

09 Jun 2024

10 Jun 2024

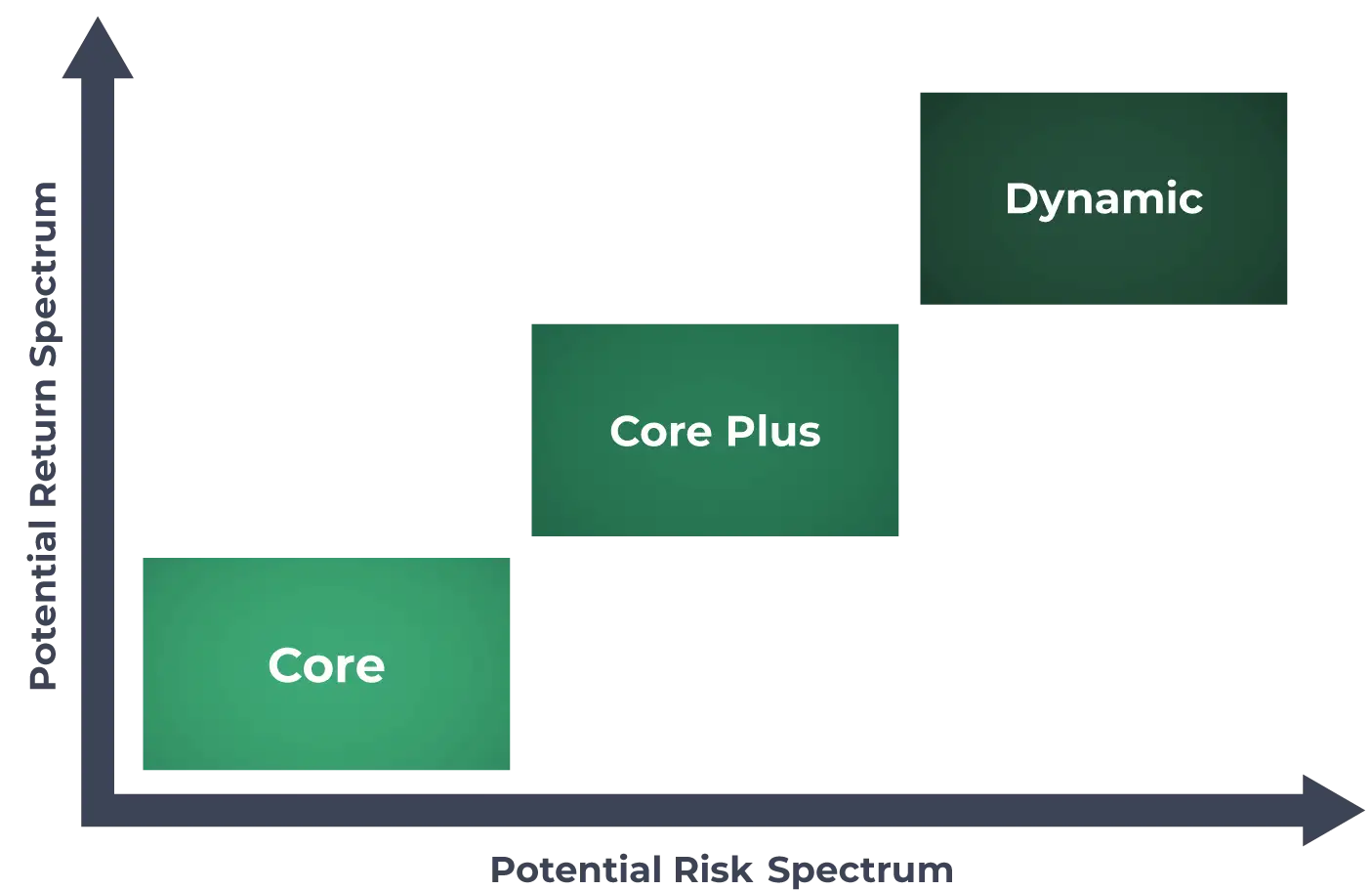

Below we break down the GreenYield investment categories. These categories represent risk profiles within the alternative investing space based on GreenYield subjective views of the specific risks mentioned within each category. All investing involves risks including the complete loss of principal. Alternative investments are highly speculative and are not suitable for all investors.

Chart shown is for illustrative purposes only and not intended to represent the result of an actual investment. Categorizations are based on GreenYield subjective views of specific risks mentioned within each category. All investing involves risks including the complete loss of principal. Alternative investments are highly speculative and are not suitable for all investors. See additional risk disclosures regarding farmland investing and the risks of investing with GreenYield.

GreenYield defines risk as a permanent loss or impairment of capital. We attempt to assess risk through factors that could cause asset loss, reduction in value, or impairment. We use three terms to describe categories of investments on the GreenYield platform: Core, Core Plus, and Dynamic.

These categories vary based on the physical attributes of a property, its region, the expected hold period, and the level of debt used to improve it. While the naming convention may sound similar to classifications used in commercial real estate, the characteristics are different for farmland, timberland, and bare land.

The purpose of these categories is to give investors a clear understanding of the general risk and return expectations of each strategy. The table below offers a broad view of how GreenYield investment strategies relate to one another. It is not representative of a specific farm or offering. Investors may choose strategies depending on personal goals, risk tolerance, and preferred timelines. For questions, contact us anytime at info@greenyield.com.

Core investments focus on owning farmland in established and proven regions for the crop type. These areas usually have many growers, operators, and investors along with strong natural resources like good water access and high quality soil. Infrastructure tends to be well developed for the specific crop.

Core investments typically avoid direct exposure to commodity risk or input cost volatility. They operate under simple lease or flex lease structures. There is no leverage and capital expenditures are minimal.

The typical cash flow profile includes annual payments from the farmer for the use of the land. Investors remain crop agnostic throughout the hold period which can help during market cycles or periods of price declines.

Most historical returns come from land appreciation. Rental income, simple lease structures, and limited capital needs can provide stability in times of inflation and market volatility.

Hold periods usually range from five to seven years. With no leverage, Core investments tend to be less volatile than the other categories.

Debt: less than five percent loan to value

Core Plus investments target higher returns by taking on slightly more risk. This may come from a more variable cash flow profile or modest capital expenditures. Some operational exposure may be included and minimal financial leverage may be used.

Capital may be needed early in the investment to fund modest improvements intended to increase productivity and intrinsic land value. Hold periods are often five to ten years. Returns come from a mix of income and appreciation.

Debt: less than twenty percent loan to value

Dynamic investments aim for higher returns and involve higher risk. These offerings often focus on properties with strong development or redevelopment potential. Farms may be underperforming due to physical issues or operator challenges which allow them to be acquired below intrinsic value.

Capital expenditures can represent a larger share of the initial investment and fund improvements such as redevelopment or permanent crop establishment. Value is created by successfully executing the improvement plan which enhances the land and often repositions the property for a more profitable use.

Dynamic strategies often involve permanent crops where investors work closely with operators. Hold periods are longer, usually five to ten years or more, because time is needed for improvements to mature or for permanent crops and timber to reach productive stages.

These investments usually carry commodity risk, operational exposure, and improvement related risk. Financial leverage is also more common with levels ranging from twenty percent to sixty percent loan to value. Returns are driven primarily by increased income rather than appreciation.

Debt: twenty to sixty percent loan to value

All investing involves risks including the complete loss of principal. Diversification does not guarantee profit or protect against loss in a declining market. Each investor should review their financial goals, risk tolerance, tax considerations, and liquidity needs before investing.

your Money

your Money